Our Story

We’ve been where you are

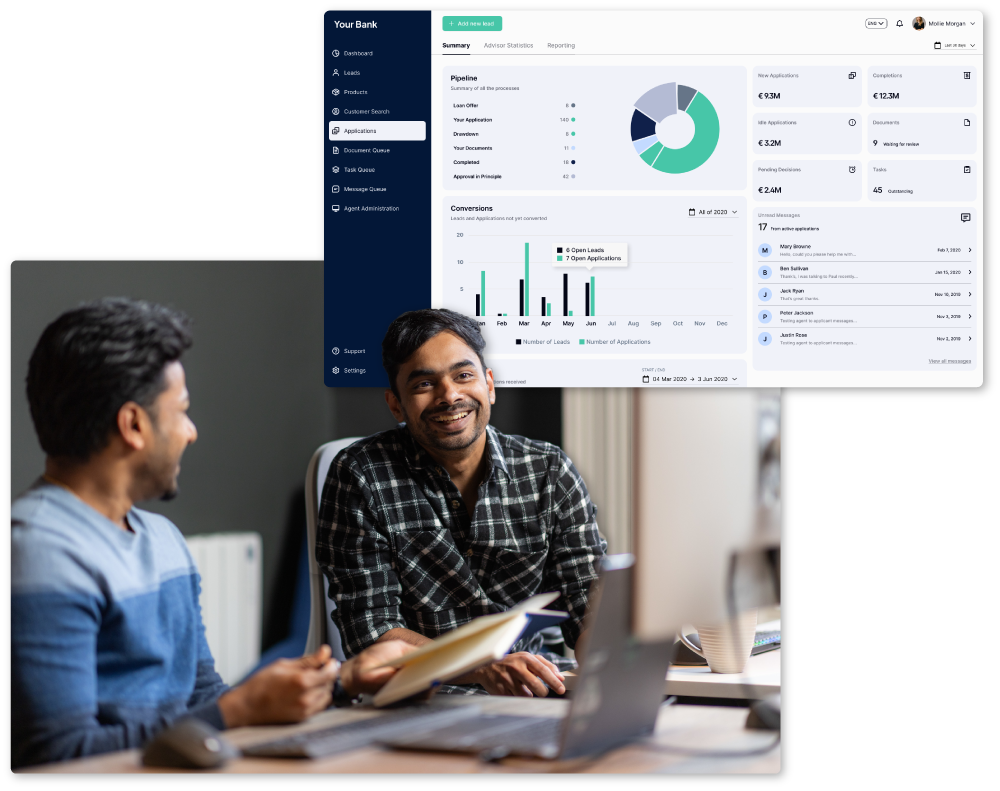

As former banking executives, we searched for software solutions to solve the inefficiencies and barriers to growth. But we found nothing. So, in 2019, we drew on our understanding of banking operations and regulations to create our mortgage origination operating system. Designed by bankers, for banks, using proven technology. No risky tech, no disruptive approaches. Just a reliable system that radically simplifies and enhances mortgage businesses.

Today, we power all the leading Irish mortgage lenders, and are expanding into other EU markets, delivering impressive results. Processing times cut by 90%. Conversions up 60%. Operating costs down by 50%. All of this in just weeks. And we’re now extending use to other complex loan verticals, like SME loans, as the approach and benefits are very similar.

Our Vision

Rather than battling the mortgage mess, institutions offering complex loans should be able to focus on growing their business and innovating – for the benefit of consumers. More loans, based on better risk profiling and decisioning, offered more conveniently, rapidly, transparently. Easier said than done!

Our Mission

We’re bent on getting there, but without disrupting or revolutionising the institutions we serve. That’s why we’ve built an origination operating system with bank-proven tech that can be deployed fast above the stack. Configured to target operating models using our banking domain expertise. For instant business impact.

Company Timeline

Our value pillars

Radical simplification

Ending the mortgage mess, for all stakeholders

Built by bankers, for banks

Deeply understanding what needs to be done

Instant business impact

Growth and efficiency, not tech for the sake of tech

Proven enterprise tech

Using banking technology proven at scale and low risk

Long-term partnership

Not a SaaS vendor, but a partner for growth & innovation

Unwavering focus

Dedicated to complex loan origination, nothing else

Meet our Leadership Team

We come from business and technology leadership roles in the banking and finance sector. That’s why we believe

we’ve built something that’s really in tune with institutions’ needs – a solution by bankers, for banks.

Eddie Dillon

Founder & CEO

Gavin Bennett

Chief Technology and Product Officer, Co-founder

Dr Martin Scott

Chairman

Niall Ennis

Chief Financial Officer

Elena Alvarez

Country Manager, Spain

Maeve Dunne

Data Protection Officer

Keith Wood

Business Advisory Board

Aodhan Flynn

Chief Operating Officer

Robin Prendergast

Head of Go-To-MarketJoin Our Team

If you love sitting behind a desk every day in a huge, slow-moving, bureaucratic company, then you certainly wouldn’t enjoy working with us. But if you love variety, challenge, autonomy and plain good craic, then we’d love to have you on board!