Beneath Spain’s buoyant property market lies a clear imbalance: house prices are climbing, yet mortgage lending has failed to keep pace. Rather than a warning sign, this gap represents a major opportunity. Non-resident demand, cautious borrowing habits, and outdated origination processes highlight the need for banks to modernise — with AI playing a central role in unlocking that growth.

Across Spanish cities, the signs of momentum are everywhere: rising international investment, limited housing supply, and steadily increasing property values. What’s missing is mortgage activity and mortgage innovation. For lenders, that gap is an open invitation to reimagine origination, harness artificial intelligence, and deliver faster, simpler journeys for both domestic and international buyers.

House prices are rising faster than credit growth

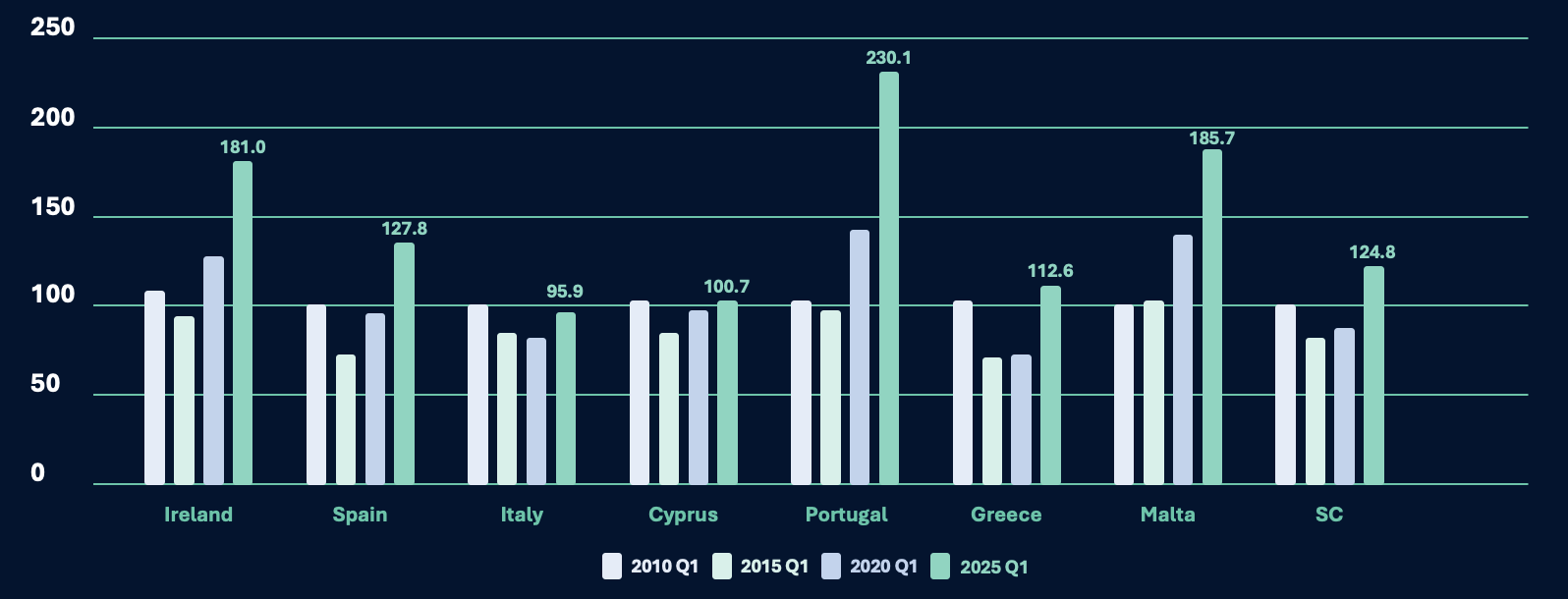

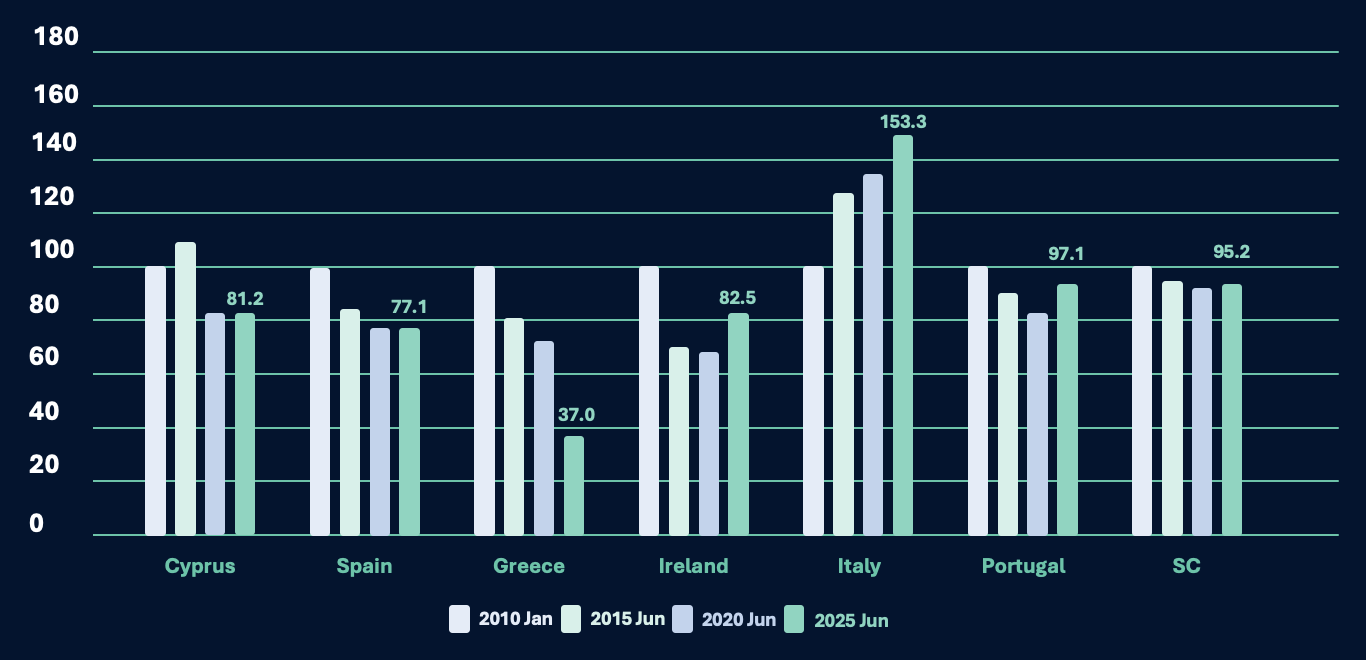

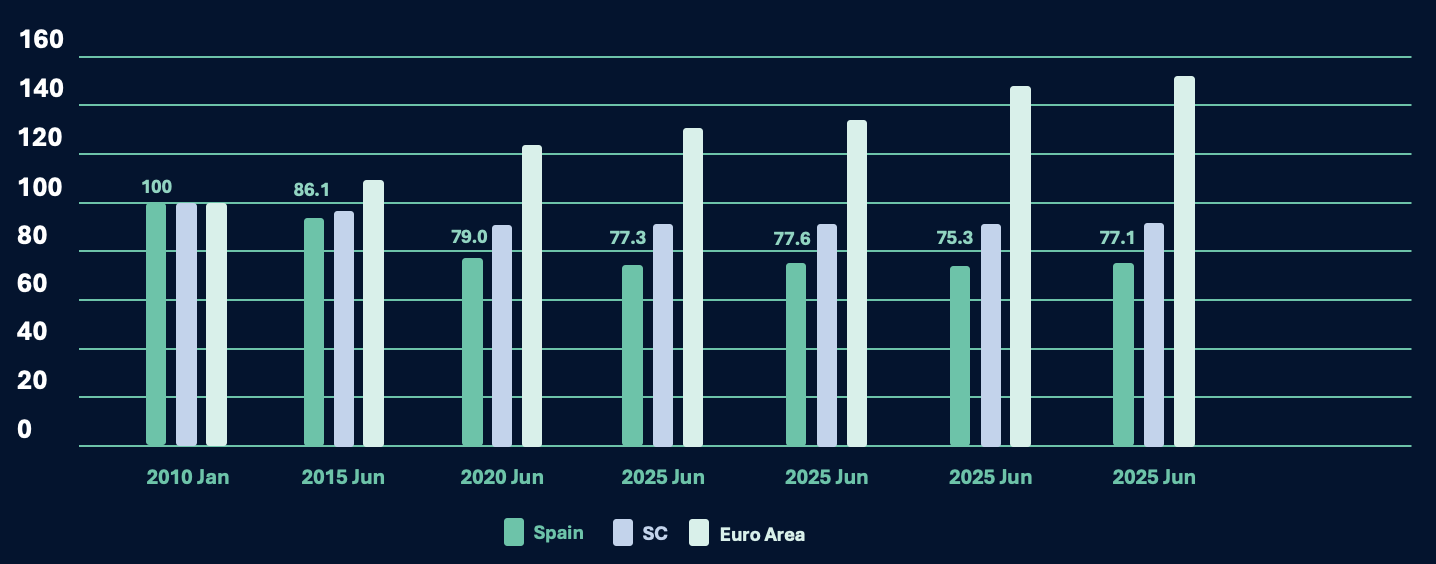

Over the past fifteen years, house prices across Southern Europe have moved higher, but mortgage markets have failed to keep pace. In Spain, a strong economy and buoyant overseas demand have translated into sustained gains in property values, while mortgage activity remains relatively subdued.

House prices continue to climb across Southern Europe, but gains vary by country.

Mortgage lending has grown much more slowly than house prices.

Foreign demand creates growth potential

International buyers are increasingly shaping Spain’s housing market. In Q1 2025, foreign buyers accounted for 14.1% of all property transactions, according to the Spanish Land Registry, one of the highest levels on record. Many of these purchases are either cash-based or financed abroad, which means Spanish banks are missing out on potentially valuable and important business.

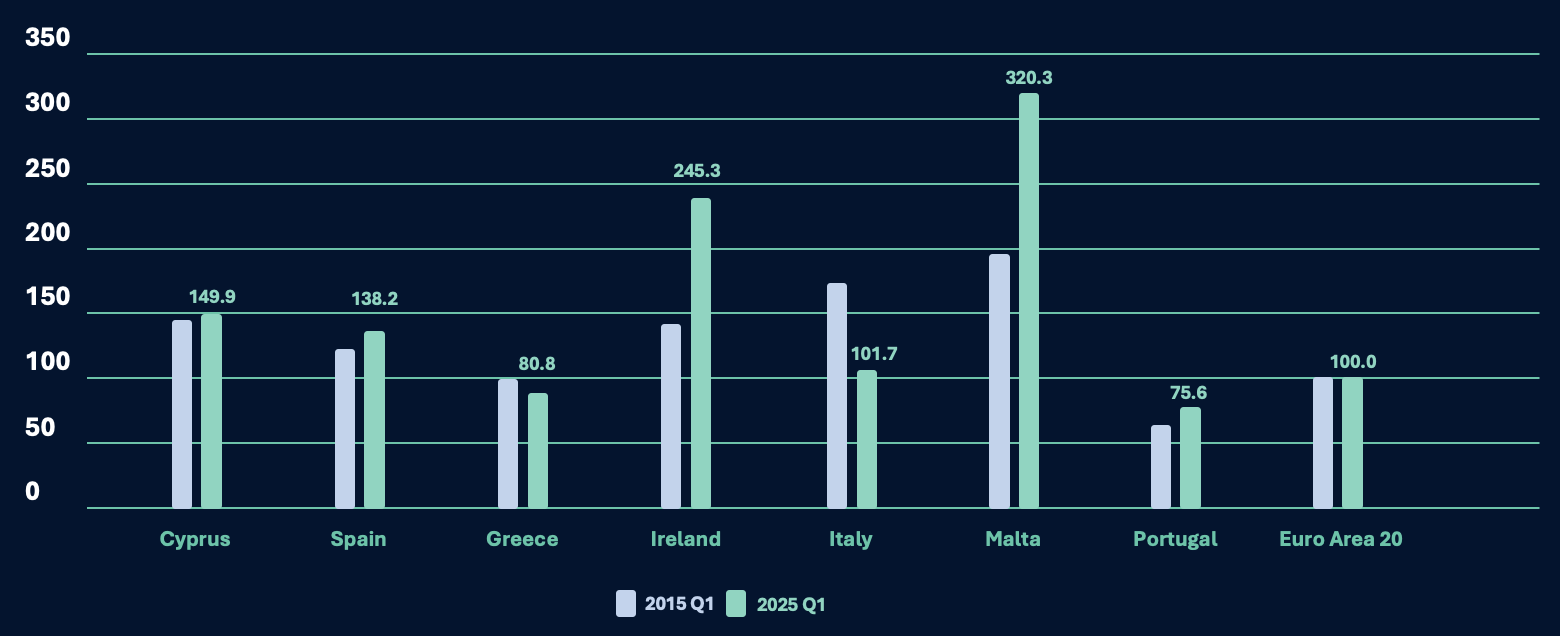

Wealth growth supports cautious borrowing

Southern European households have grown notably wealthier in recent years, but this has not been accompanied by a rise in mortgage debt. This suggests households are financially stronger but borrowing behaviour has been altogether more cautious. Domestic households are building wealth without an accompanying reliance on debt. For domestic banks, these developments signal important structural changes that present a range of opportunities in the shape of a resilient base of (new international) customers, a base that offers significant potential for responsible, sustainable and rewarding growth in mortgage lending.

Households are building wealth without relying heavily on debt.

Origination as the key lever

The biggest opportunity for Spanish lenders lies in modernising origination. Legacy systems, manual workflows, and fragmented compliance processes make it difficult to serve non-resident buyers effectively. By evolving origination, banks can utilise AI and no code software solutions to simplify documentation, reduce friction, and better compete with foreign lenders.

Spain’s mortgage market lags the Euro area, highlighting scope for catch-up.

Outlook

Spain’s housing market continues to attract strong international demand and remains one of Europe’s most dynamic property sectors. The challenge and opportunity for Spanish banks is to align mortgage origination with this demand. By developing non-resident mortgage solutions and modernising origination processes, institutions can unlock new lending growth while strengthening customer relationships domestically.

__

Cognita by CreditLogic is the first AI-powered Origination Operating System (OOS), designed by bankers for bankers and purpose-built for speed, agility, and compliance. It simplifies fragmented processes, data flows, and technology stacks across financial services. Founded in Ireland in 2019, with its European headquarters in Madrid, CreditLogic delivers SaaS solutions that automate financial processes, optimise risk management, and prevent fraud. Today, it is a trusted technology partner to leading European banks, governments, and public sector entities.