Empower applicants, mortgage advisors, and credit controllers with seamless digital mortgage experiences to accelerate approvals, reduce costs, and boost competitiveness.

Streamlined mortgages from pre-qualification to close

Built by bankers, the CreditLogic Origination Operating System is a highly configurable and proven SaaS platform that radically simplifies mortgage operations in just weeks, without risk. It unifies data, documents, and communications while automating processes and workflows.

Omni-channel applicant journey

Digital workflows for simulation, enquiry, application, and instant feedback.

AI-driven application processing

Advanced data and documents validation for streamlined and efficient pipeline processing.

Intelligent document exchange

E-proposals, document uploads, and contract e-signatures enabled with ease.

Enhanced decisioning

Automatically generated credit affordability, scores and approval packs for faster outcomes.

Interactive engagement

Real-time text & voice chat for seamless engagement between applicants and advisors.

Curated experiences

Co-pilot assistance powering digital alerts, nudges and insights for sustained engagement.

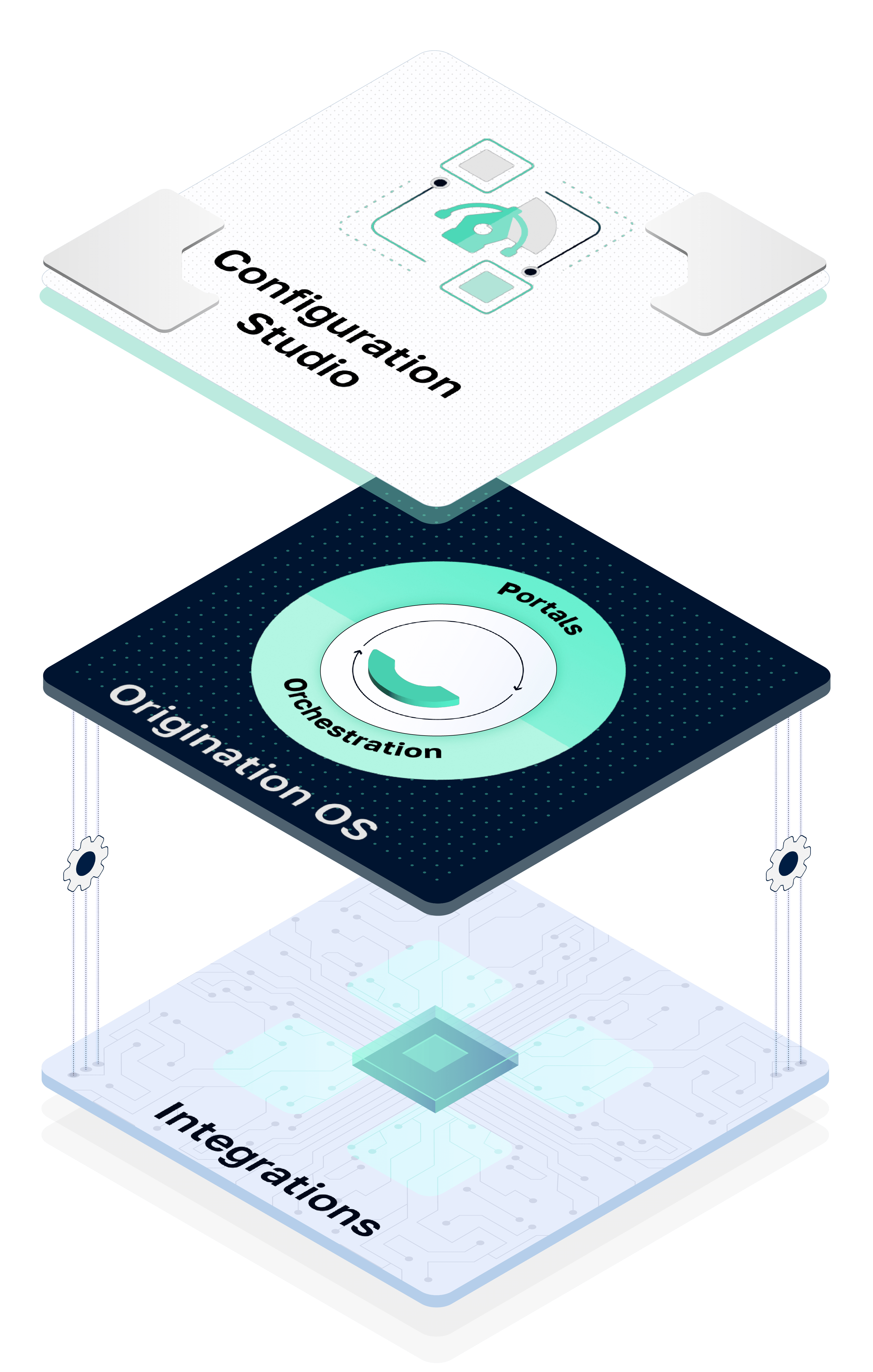

HOW IT WORKS

Delivered across three platform pillars

Activate, Operate, and Enhance form the core of the CreditLogic Origination OS, accelerating transformation, simplifying complexity, and ensuring scalability.

Activate

Use the codeless drag & drop Configuration Studio to create and configure your instance in alignment with your target operating model in just weeks. Accelerate time to value. Outpace competition.

Operate

Get radically enhanced and automated processes, workflows, compliance. Engaging UXs. Unified data, documents, views, communications. Empower your teams. Engage and convert applicants. Slash costs.

Enhance

Extra modules. Advanced configuration. Painless integrations. Extension to other complex loan products. Expert Services and Training. Stay ahead trends with minimal effort, zero disruptions.

ACTIVATE. OPERATE. ENHANCE.

Fastest time and lowest risk to value

Empower your bank changemakers with our no-code, drag-and-drop Configuration Studio to design and align your instance with your target operating model—all in just weeks.

Instant cloud instance setup

Create & brand cloud-based instance in a few clicks

Drag & drop configuration

No-code configuration of portals, UXs, processes, workflows

Automate tasks and workflows

Define automation of tasks, decision flows, notifications, alerts

<12 weeks

Configuration and deployment

Instant scale

Handle hundreds of applications per hour

First-mover

Game-changing new product launches

Take the lead in digital origination

MVP in weeks. Engage and convert applicants faster than competitors.

Radically improve agent productivity, efficiency and compliance.

ACTIVATE. OPERATE. ENHANCE.

Radically improve UX, productivity and control

Empower your applicants and bank teams with engaging user experiences, seamless automated workflows, unified data, and embedded compliance and risk management.

+60%

Higher lead pipeline conversions

-90%

Lower lead processing times

-50%

Lower operating costs

ACTIVATE. OPERATE. ENHANCE.

Stay ahead of competition, market and regulations

Scale effortlessly by adding new modules, loan products, and third-party integrations.

Integrate and extend your system

- Integrate with your core, CRM, other systems

- Extend to other complex loan products e.g. SME loans, car loans

Expert Services, Training, Support

- Personalised on-demand training

- Premium personalised support

- Ad-hoc reporting & analysis

+5pp

Gain in new drawdown market share

<1 hour

Time to activate new value-add modules like Open Banking, eKYC

<4 weeks

Time to extend platform to new loan products or onboardings

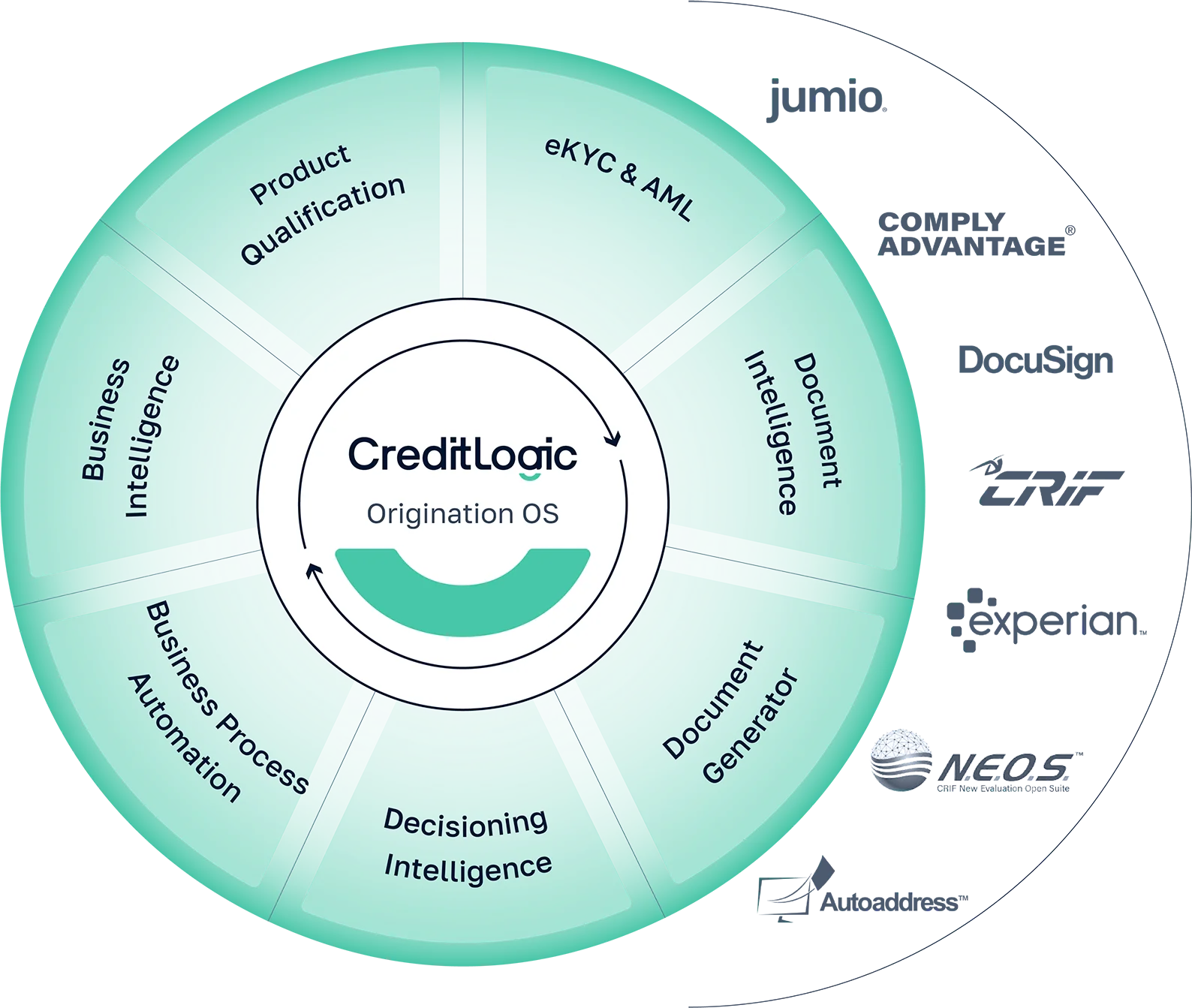

A rich ecosystem

of partners

Our open architecture facilitates the seamless integration of complementary solution providers directly into business processes and workflows.